Everything You Need to Know About Annual Reports

If you’re starting a new business, you probably know how complicated it can be to keep up with the latest filing and compliance regulations. Annual reports are one of the most common types of documents filed by LLCs, C-Corps and other businesses, but the rules about annual reports can be surprisingly confusing. With regulations different in each state, things get tricky fast for businesses that operate in multiple states.

In this article, we'll explain what you need to know about annual reports as a startup or small business founder. Firstbase Agent automatically tracks annual report deadlines and other ongoing compliance requirements — click here to sign up and let us take the headache out of your annual reports.

What Is an Annual Report?

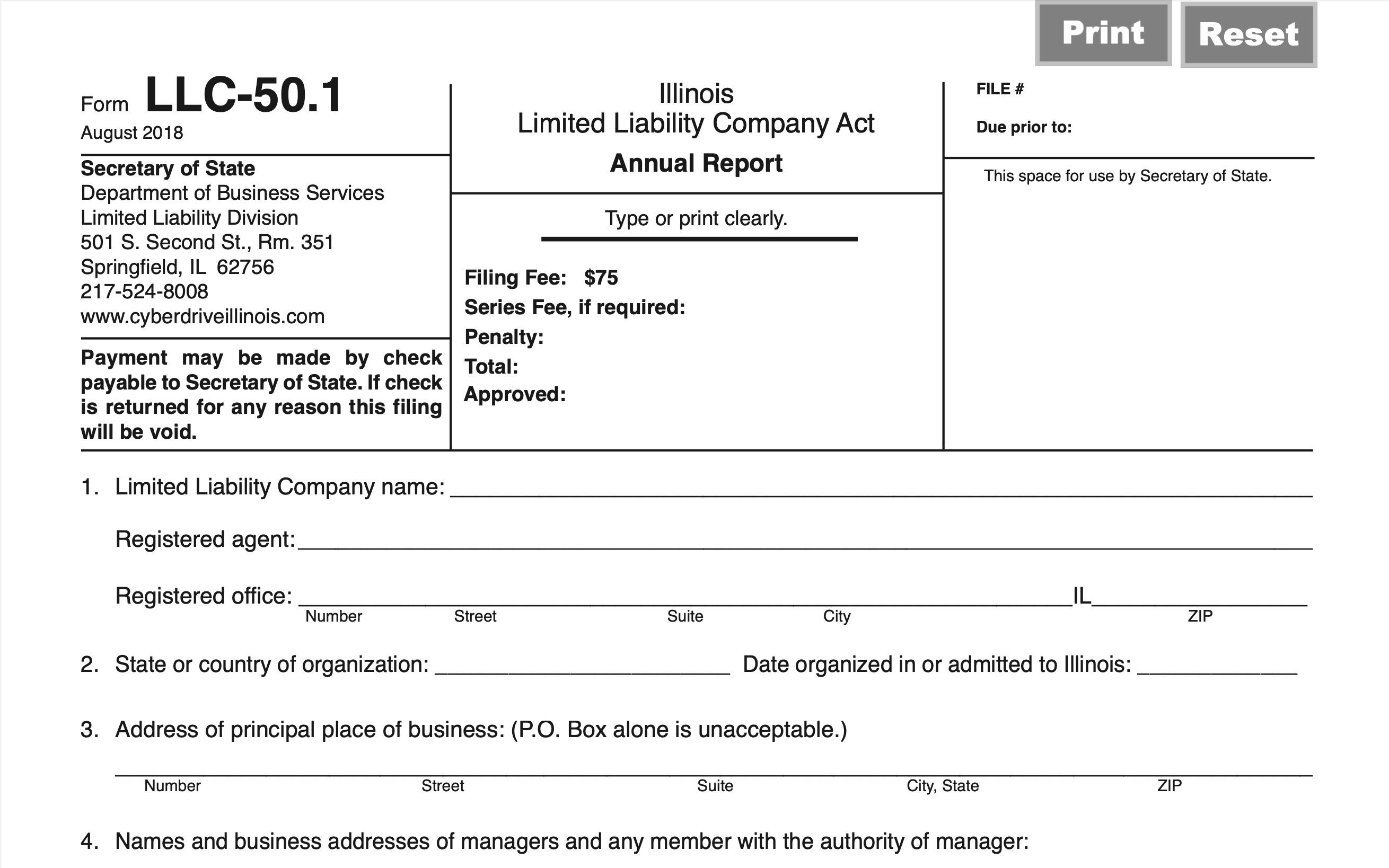

Annual reports are filings that provide a snapshot of your business operations as well as any changes that occurred in the previous year. The specific requirements vary from state to state, but most annual reports contain similar information.

Annual reports are a key compliance requirement for companies that do business in the United States. While they don’t take very long to fill out, deadlines can be hard to follow and businesses can face serious consequences if they fail to meet their obligations.

Keep in mind that this kind of annual report is different from the annual reports provided to shareholders by publicly traded companies.

When Do I Have to File?

Most US states require one annual report per year. A handful of states only ask for reports every other year, while some don’t require an annual report at all. Pennsylvania is a little different, with reports required just once every ten years.

One challenge of annual reports is that each state has its own filing deadlines. To make things even more confusing, some states have the same deadline for every business, while other states adjust requirements based on when each business was founded.

For example, Alaska requires biennial reports by January 2nd, while Michigan requires them no later than February 15th. A total of 20 states have deadlines that vary depending on the company’s anniversary. This table of annual report deadlines is a helpful resource for any business owner.

If your business operates in ten states, there’s a good chance that you’ll need to meet ten different filing deadlines. This adds a substantial degree of complexity, particularly for smaller businesses.

Firstbase Agent makes things simple by generating automated email reminders and dashboard notifications as each deadline approaches. With Agent, you’ll never have to worry about navigating this complicated legal landscape.

What Information Do I Have to Provide?

On top of different filing deadlines, each state also has its own disclosure requirements for annual reports. You will need to check for each state in which your business operates. For example, the Washington state annual report form calls for:

- The business name and Unified Business Identifier (UBI)

- The name, address, business, job title, and contact information of the registered agent

- The address of the principal office

- The individuals and/or businesses responsible for governing the business

- The kind of work the business performs in Washington

- Information used to determine real estate excise tax obligations

- Whether the business wants physical mail sent to the registered agent’s address

What If I Miss Annual Report Deadlines?

Failing to file annual reports on time can lead to serious consequences. The most obvious penalty is the late filing fee. For example, Washington state LLCs pay an extra $25 if they miss the deadline. That might not sound like much on its own, but these charges can add up quickly if you start missing deadlines in multiple states.

More seriously, you could lose your license to operate in a particular state if you miss the annual report deadline. If you realize you missed a deadline, make sure to file and pay the late fee as soon as possible to avoid being dissolved.

Even short of dissolution, simply falling out of good standing could also open you up to additional liability. Liability protections and other legal safeguards may not apply if it turns out that your business was not in good standing at the time of an incident.

How to File an Annual Report

You can view forms and file annual reports in most states through the website of the corresponding Secretary of State. Make sure to avoid doing this at the last minute so that you have time to gather any information you might be missing. Firstbase Agent makes this process easier by filing annual reports for you based on information about your business.

While some states accept online filings, others may require you to mail a physical form to the office of the Secretary of State. Keep in mind that you will also have to pay a filing fee in order to stay in good standing with the state office. Since each state works differently, it's tough to stay on top of all filing requirements and procedures without a unified dashboard.

Final Thoughts

Annual reports might seem like a simple task, but the truth is that they’re easy for new business owners to miss. As your company grows, it’s important to develop processes for keeping track of annual report deadlines and making sure you file in time in every state where your business operates.

Firstbase Agent was designed from the ground up to make annual reports and other requirements easier for business owners to manage. Click here to learn more about how Firstbase Agent can streamline compliance for your small business.